Initial new-crop estimates from the USDA underpinning commodities? Analyst Insight

Thursday, 13 May 2021

Market Commentary

- New crop UK wheat futures (Nov-21) closed yesterday at £187.00/t, gaining £0.40/t on Tuesday’s close.

- Conab revised down the second Brazilian maize crop to 79.8Mt, from 82.6Mt estimated in its April report. Drought across key growing regions has hindered yields.

- Defra on-farm stocks were released this morning. For England and Wales 2,657Kt of wheat was on-farm in February, decreasing by 41% on the same time last year.

- Further to that AHDB released cereal stocks data this morning. Estimating that 1,187.6Kt (-7.4% year-on-year) of home-grown wheat and 270.5Kt (+40.4% year-on-year) of imported wheat was held by merchants, ports, and co-ops in the UK. More information can be found here.

- UK trade data released yesterday showed the UK imported 176.6Kt of wheat and 183.4Kt of maize in March. This brings our total combined imports of maize and wheat to over 4.0Mt for the season to date.

Initial new-crop estimates from the USDA underpinning support for commodities?

The May USDA World Agricultural Supply and Demand Estimates (WASDE) report was released yesterday including its first estimates for the 2021/22 marketing year.

This report is important to global industry and can set the market tone for the coming season. Speculators anticipate these reports as they give a global overview of supply and demand.

Old crop revisions

Within the May report, most estimates for the 2020/21 season were relatively unchanged from the April report. The main change was the Brazilian maize crop being revised down to 102.0Mt from 109.0Mt. This had been anticipated from the dryness within the Safrinha growing regions over the last few weeks.

This reduction will reduce Brazil’s capacity to export and therefore demand for US maize will increase. From April to May the US export forecast was increased by 2.5Mt because of this.

Furthermore, Chinese imports of maize were revised up to 26.0Mt, from 24.0Mt in April. This will provide support for old crop prices. New-crop US maize sales further suggest China are expected to continue purchasing.

New crop estimates – grains

The latest WASDE report projects record production and use of coarse grains in 2021/22, and larger ending stocks. But this depends on favourable global weather and purchasing commitments continue from China.

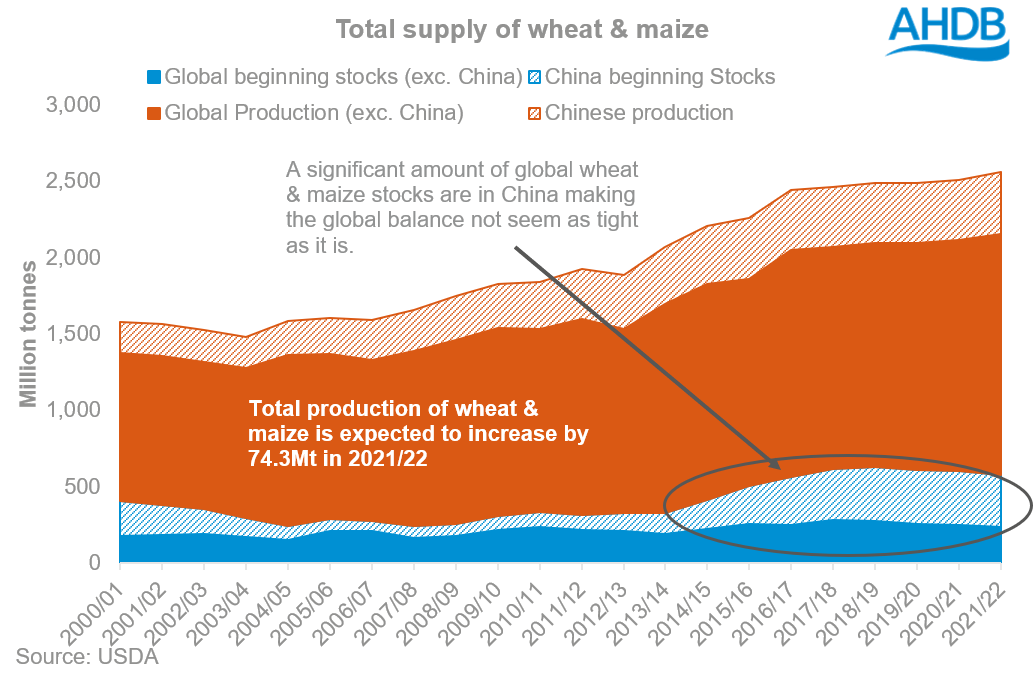

For wheat, the outlook is for increased supplies. Global production is expected to increase 12.9Mt from 2020/21 to 789.0Mt in 2021/22.

Increased year-on-year production for Argentina (+2.9Mt), the EU (+8.1Mt), UK (+4.4Mt), Morocco (+4.2Mt), Ukraine (+3.6Mt) and the US (+1.3Mt) is expected to offset reductions for Australia (-6.0Mt) and Canada (-3.2Mt).

Australia’s production will decrease due to yields reducing and a proportion of the Canadian wheat area for next season has been sacrificed for canola. However, UK production is expected to rebound to 14.1Mt.

With higher global production, there are estimates of increased global consumption of wheat for 2021/22. Therefore, global imports are expected to rise by 6.0Mt.

China’s imports are projected slightly down 0.5Mt to 10.0Mt. Chinese stocks will continue to decline despite higher wheat production, which will increase by 1.8Mt to 136.0Mt. The reason for this decline is demand remaining historically high.

Despite an increase in global consumption ending stocks are expected to remain high in 2021/22 at 295.0Mt. But, China accounts for 48% of the total.

In 2021/22 ending stocks are expected to reduce in the US and Australia, but rebuild in Argentina, the EU, Russia, Ukraine and Kazakhstan. However, the global increase in ending stocks is only a marginal increase of 0.3Mt on 2020/21 ending stocks.

Global production of maize is expected to increase by 61.4Mt for 2021/22. This is due to increased year-on-year projections production for Argentina (+4.0Mt), Brazil (+16.0Mt), Ukraine (+7.2Mt) and the US (+20.5Mt).

The US is forecast to produce 380.8Mt. This would be the second-highest production ever, with 2016/17 being the highest at 384.8Mt. US ending stocks could grow by nearly 20% year-on-year estimated to be 38.3Mt. The stock-to-use will be up on the year but below 2014/15 – 2019/20 levels.

Maize exports out of the US are expected to be supported during the first half of 2021/22 as South American production isn’t as high as expected. But, the US export share for the whole of the 2021/22 marketing year is estimated to reduce due to Ukraine and Russia increasing their shares.

Global consumption of maize is estimated to rise 26.6Mt year-on-year, while global production is estimated to increase 61.4Mt. So, the global stock-to-use is expected to rise from 24.7% to 24.9%. However, excluding China, the stock-to-use is only marginally up at 10.7%, the second lowest since 2012/13.

China is expected to increase its maize production by 7.3Mt for 2021/22. But, they are still expected to import 26Mt, which is identical to 2020/21. We will only start to know if this projection will be realised when we progress throughout the marketing year.

Oilseeds

Global oilseed supplies (stocks and production) for 2021/22 are projected to increase 3% from 2020/21 to 732.4Mt. Inflated prices throughout 2020/21 have incentivised the expansion of the oilseed area. As a result, oilseed ending stocks in 2021/22 are expected to increase to 104.6Mt, up from 100.2Mt in 2020/21.

Global soyabean production is estimated to increase 22.6Mt to 385.5Mt. Large drivers of this are the year-on-year increases from Argentina (+5.0Mt), Brazil (+8.0Mt), and the US (+7.3Mt).

The US is estimated to produce a crop of 119.9Mt, the largest since 2018/19. Despite this large crop its stocks are expected to marginally increase to 3.8Mt, up from 3.3Mt in 2020/21. The reason for such low stocks in 2020/21 was due to China purchasing large quantities.

For the 2021/22 marketing year Chinese imports are estimated to increase by 3.0Mt to stand at 103.0Mt.

Global ending stocks are estimated to be 91.1Mt, up 4.6Mt, with Brazil and China being the main contributors to the rise. The world stocks-to-use ratio (inc. China) is expected to marginally increase from 23.4% to 23.9%.

Global production of rapeseed is forecast to increase by 1.8Mt to 73.2Mt. A large driver of this is the increased Canadian area, with production in the country estimated up 1.5Mt at 20.5Mt.

Production in the EU-27 is estimated to only marginally recover by 0.4Mt to 16.6Mt. Meaning that an estimated 6.4Mt of imports is required for 2021/22, identical to the 2020/21 marketing year.

Exports out of Canada and Australia are expected to decrease slightly year-on-year.

Global ending stocks are forecast at 5.5Mt, down from 5.8Mt in 2020/21. There is also a tightening global stock-to-use ratio from 7.9% to an estimated 7.5% in 2021/22.

Supported commodities complex for 2021/22?

Although these are only initial projections for the 2021/22 marketing year, we can start analysing what may be expected.

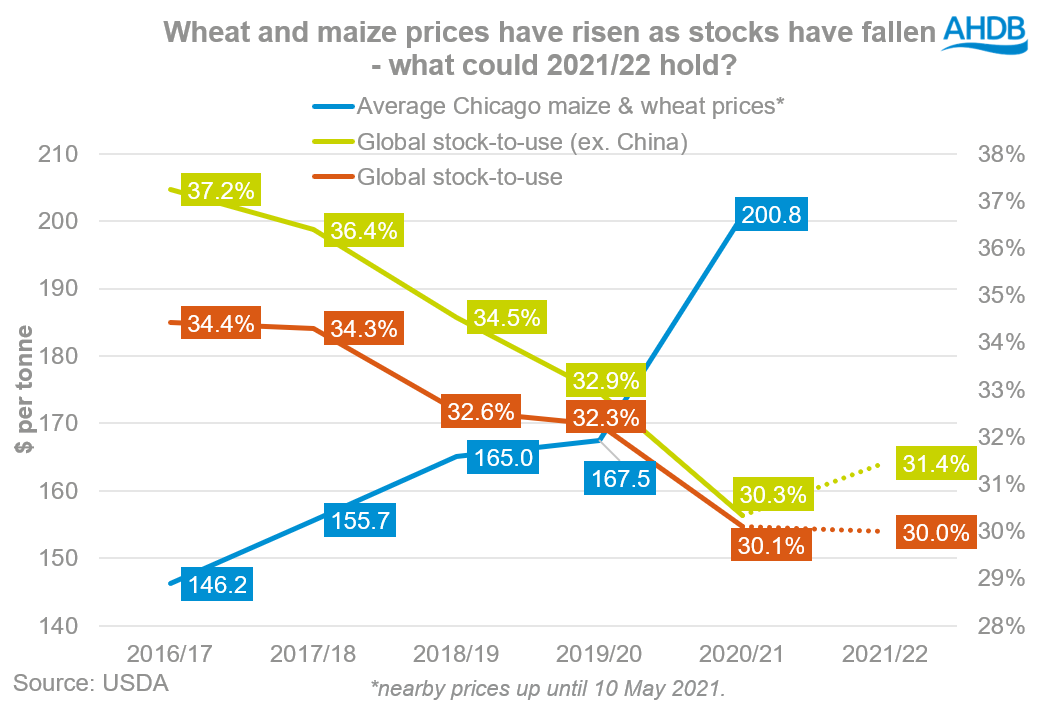

Chinese purchasing, combined with weather issues, has underpinned the market in 2020/21. It led to tighter stocks relative to demand (stocks-to-use ratios) for maize and soyabeans. Tighter maize supplies and stocks helped push up wheat prices.

As maize stocks-to-use ratios fell in recent years, the average price of Chicago maize and wheat increased.

For 2021/22, the stock-to-use for maize and wheat (ex. China) is projected to marginally increase from 30.3% to 31.4%. However, if China is included the stock-to-use is expected to reduce from 30.1% to 30.0%. Therefore, with stocks not totally recovering this could lead to support for 2021/22 too. Arguably, this depends on whether China continues to purchase the high amounts they did in 2020/21. But, there are a lot of parameters that could change these initial projections; they are not set in stone.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.