Australian beef in the UK

Thursday, 17 June 2021

The UK has recently agreed a Free Trade Agreement with Australia, which among other things will increase market access to the UK for Australian beef.

Some details of the deal have been released by the Australian Prime Minister:

“Beef tariffs will be eliminated after ten years. During the transition period, Australia will have immediate access to a duty-free quota of 35,000 tonnes, rising in equal instalments to 110,000 tonnes in year 10. In the subsequent five years a safeguard will apply on beef imports exceeding a further volume threshold rising in equal instalments to 170,000 tonnes, levying a tariff safeguard duty of 20 per cent for the rest of the calendar year.”

Until now, Australia had been exporting modest amounts of beef to the EU (including the UK), typically under a quota arrangement paying a 20% tariff rate. Prior to the low beef prices we experienced in 2019, the UK had been importing 2,500-3,000 tonnes of beef from Australia, down from over 7,000 tonnes in 2013 and 2014. This is out of a total UK annual import demand of around 270,000 tonnes of beef, the majority of which is served by the EU, and by Ireland in particular. So on the face of it, 35,000 tonnes of access rising to 170,000 tonnes is significant.

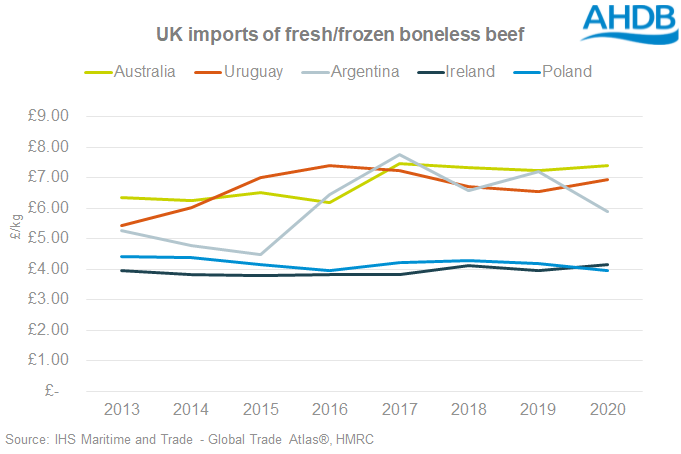

The UK is around 75% self-sufficient in beef and does need to import product to meet demand. The price of some of these imports from selected countries is shown above. Beef imported from Australia will more likely be higher value steaks, and at the moment if under the quota for high quality beef, would incur a further tariff of 20% on top of the price shown above, as would beef from Uruguay and Argentina. The Irish price is that much lower because it will include a wider range of boneless products, including for example mince.

It is the erosion of value in the premium tier of cuts that concerns the UK beef sector. When making a global comparison, steaks in the UK are relatively expensive, balancing as they do our relatively cheap mince. Increased trade with the rest of the world, accelerated by FTAs like this one, could mean more harmonisation of UK and world prices, across all cuts. We can now export manufacturing beef for grinding/mincing for burger production to the huge US market, so although increased competition in the steaks market would reduce prices, could we expect mince prices to increase?

We cannot forget that Australia is something of a global powerhouse when it comes to exporting beef, but does that mean large volumes will be hitting UK shores?

Initially, perhaps not that much. Australia is coming out of a period of extended drought, and is not exporting as much as it has in recent years. Livestock prices have been very high, reducing competitiveness, and it is likely it would take some time for supply chains to develop to the satisfaction of UK retailers. However, exports are increasing again and ABARES forecasts beef and veal export volumes to increase by 16% in 2021/2022.

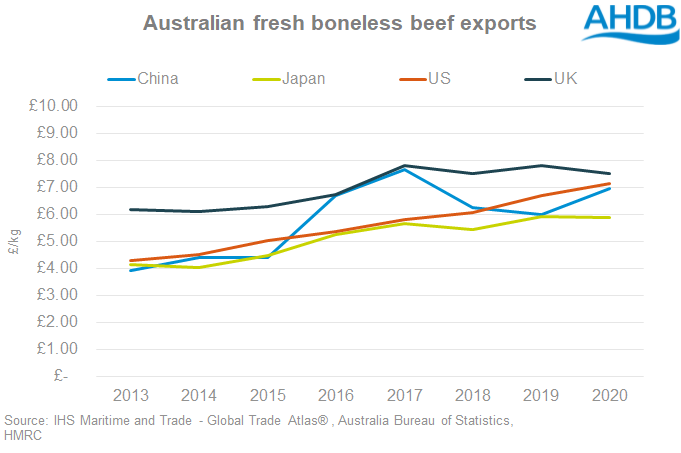

Australia has access to a wealth of other markets around the world, and although the UK is a premium market, the price gap between exports to the UK and other important destinations has been narrowing. This partly explains why Australia’s use of its EU quota has been falling in recent years. Reports suggest that Australia “only” expects to compete in the UK with EU beef exports. It will need to do this on price, and this is likely to be in the premium tier of imported products.

So Australia may not immediately export huge volumes of beef to the UK, either because it does not have huge volumes to spare, or it has other attractive markets elsewhere. But the scope really is there to affect the price structure of beef in the UK, and the effect of that is a lot harder to predict.

This brings us back to the fact that more FTAs will connect us more closely with world markets and prices. Logic suggests that any potential volumes that come in from Australia could act as a price ceiling in UK markets for some cuts, albeit a moving one in line with world markets at the time. A focus on shipping specific cuts to the UK could have an impact on overall carcase values here.

For UK beef producers, there is a clear rationale not only to focus on costs, but also to prepare for more volatility. These changes are not immediately straightforward to manage in a sector where risk management options are currently limited, and the questions on maintenance of standards and impacts of future trade deals remain areas of development that we will, as always, be analysing.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.