Which grain to feed in 2021/22? Grain market daily

Tuesday, 26 October 2021

Market commentary

- May-22 UK feed wheat futures rose £1.90/t yesterday to the contract’s highest price yet, £219.50/t. Meanwhile, the Nov-22 contract gained £0.40/t to 191.50/t. Global wheat prices rose due to ongoing strong demand for wheat.

- The notice period started for the UK feed wheat Nov-21 futures contract yesterday. It finishes trading on 23 November. The number of remaining open contracts is dwindling, so the May-22 contract is now a much better indicator of pricing.

- The EU’s MARS report shows good progress in planting winter crops across much of Europe. Currently new crop feed wheat futures are supported by the old crop situation. But, how high they are when we reach harvest will depend on how the 2022/23 crops develop.

- After the UK market closed, the USDA released its first assessment of the condition of the 2022/23 US winter wheat crop. 46% is rated as ‘good’ or ‘excellent’, vs 41% last year, but well behind market expectations of 54% (Refinitiv).

Which grain to feed in 2021/22?

We’re likely to see changes to the amount of each grain fed to animals in 2021/22. This is due to price changes for those grains compared to last season.

Barley usage to shrink?

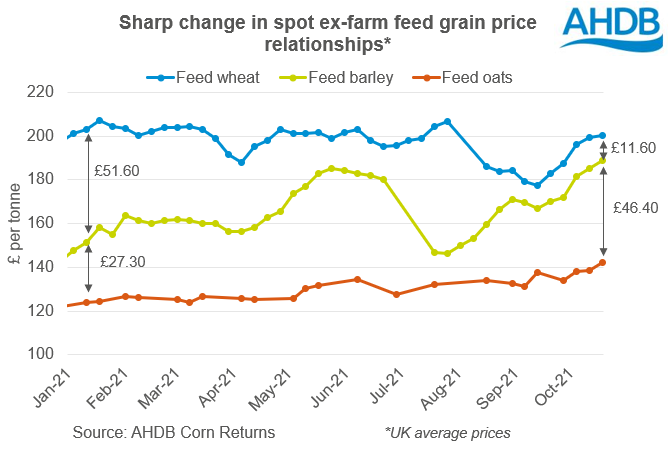

Spot ex-farm feed barley prices were just £11.60/t below those for feed wheat, on average across the UK last week (up to 21 Oct). Last season, barley averaged £44.40/t below feed wheat, but at times the gap was as large as £54.30/t.

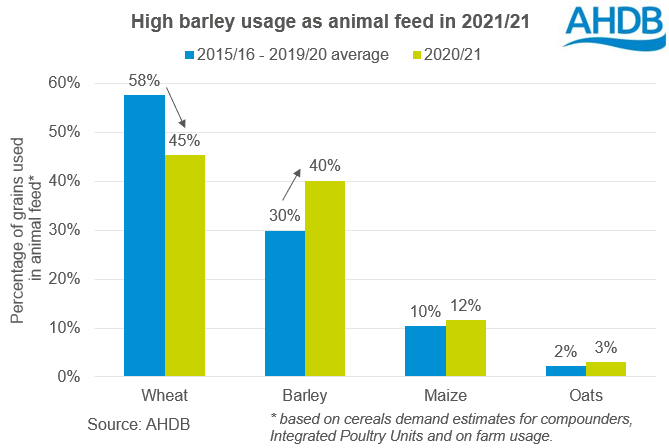

As a result, barley accounted for 40% of all grain (wheat, barley, maize, and oats) fed to animals in the UK. This was well above average. It reflected the small 2020 UK wheat crop (9.7Mt) but more ample barley availability.

The smaller price gap is likely to cut the amount of barley fed to animals this season, but by how much? Revisiting analysis from earlier this summer with today’s prices points to a bigger drop in barley usage. That analysis only looks at barley usage (as a percentage of all cereals) by GB compounders and Integrated Poultry Units (IPUs), excluding NI and on-farm usage. Barley usage by these sectors could be closer to the five-year average (18%) looking at current prices.

However, in July and August, barley usage by GB compounders and IPUs stayed high, at around 27% of cereals. This is likely linked to delays in harvesting the 2021 wheat crop, both in the UK and in Europe.

A factor that could keep demand for barley higher than price alone suggests, is the ongoing challenges faced by pig producers. A lack of butchery capacity is limiting the ability to clear additional pig numbers and keeping pigs that are ready for slaughter, on farm longer. This means an increased need for maintenance diets, which are higher in fibre, and barley is often used.

Role of other grains

Looking at current prices, we’re also likely to see the amount of oats used as animal feed prices stay relatively high. Last season 397Kt of oats were used, the highest in electronic records (back to 1999/00).

Another large oat crop (1.1Mt) means ex-farm feed oats are currently £46.40/t cheaper than feed barley and £58.00/t below feed wheat. This is a similar discount to wheat as last season but a far larger discount to barley. These discounts are likely to incentivise oat usage as animal feed where possible.

Meanwhile, maize usage in animal feed is likely to fall from last year’s high level of 1.53Mt. This reflects the current high cost of importing maize into the UK.

First forecasts

AHDB releases its first estimates of UK supply and demand for wheat and barley on Thursday in the 2021/22 Early Balance Sheets. The first official UK supply and demand estimates covering wheat, barley, maize, and oats are out on 25 November. These estimates will be covered in Grain market daily.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.