- Home

- Coronavirus: business advice and support

Coronavirus: business advice and support

Information for employers and employees on issues such as recruitment, finances and personal support.

Advice for employers in England

Guidance is available for businesses through the GOV.UK site, including advice on statutory sick pay packages, business rates, grant funding at varying levels, the Business Interruption Loan Scheme, and HMRC schemes (VAT deferral and Time to Pay service for outstanding tax liabilities).

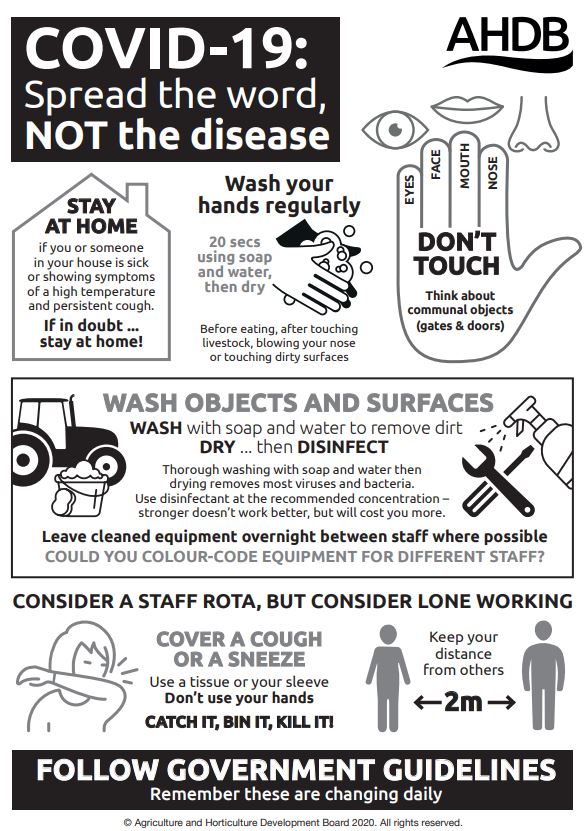

This guidance will assist employers and businesses in providing advice to their staff regarding the novel coronavirus, COVID-19. It talks about how to help prevent its spread, and what to do if someone has symptoms in your business.

Visit COVID-19: support for businesses (gov.uk)

Visit COVID-19: guidance for employees, employers and businesses

Access guidance for social distancing in the workplace (gov.uk)

Your Local Enterprise Partnership (LEP) will be able to provide practical support, advice and guidance to your business.

Find out how LEP Growth Hubs are supporting business through COVID-19

The Rural Payments Agency (RPA) has provided information about how Coronavirus affects the Basic Payment Scheme (BPS) and Countryside Stewardship.

Financial support

If you’re considering applying for the Business Interruption Loan Scheme, listen to our podcast which talks through the aspects of the scheme and how to apply.

The following advice and templates will help you pull together financial information for your business which may be needed for your application.

Webinar: Knowing your business and keeping the bank manager on side

Develop a mutually beneficial relationship with your lender using basic skills and tools to review, analyse and interpret your own farm business tax and management accounts.

Webinar: Practical budgeting and cash flow forecasting

This webinar explains these useful management tools and their benefits – what good looks like, how much detail to go into, and how often to update and monitor them.

Advice for Welsh, Scottish and NI businesses

The Welsh Government has announced a package of support worth £1.4bn for small businesses to help during the coronavirus outbreak.

Visit the Business Wales website

COVID-19: Information for individuals and businesses in Wales (gov.uk)

The Scottish Government is regularly updating its advice and support for Scottish business.

The DAERA is constantly updating its guidance for farmers in Northern Ireland.

Advice for employees

There is also guidance available for employees of businesses that may be affected, looking at Statutory Sick Pay, furloughed workers and further support available for individuals either directly employed or self-employed and contracting.