Analyst Insight: bioethanol demand adding fuel to feed grain prices?

Thursday, 11 November 2021

Market commentary

- UK feed wheat futures (May-22) continued to rise yesterday, gaining £4.50/t, to close at £225.00/t.

- This follows global contracts, Chicago and Paris (May-22) which gained $8.63/t and €8.25/t respectively.

- French maize harvest is set to be a big one. French grower group AGPM suggest record average yields could be achieved this time. They also predict 85-100Kha could shift from fodder maize to grain maize as farmers want to take advantage of current high prices. They predict the crop could reach 16.5Mt, 2Mt higher than the current France farm ministry estimate.

Bioethanol demand adding fuel to feed grain prices?

Recent US bioethanol demand has been strong. With an average of 36% of US maize used for ethanol over the past 2 marketing seasons, strong demand supports Chicago maize prices. This in turn strengthens the wider feed grain complex, adding support to UK feed grains also.

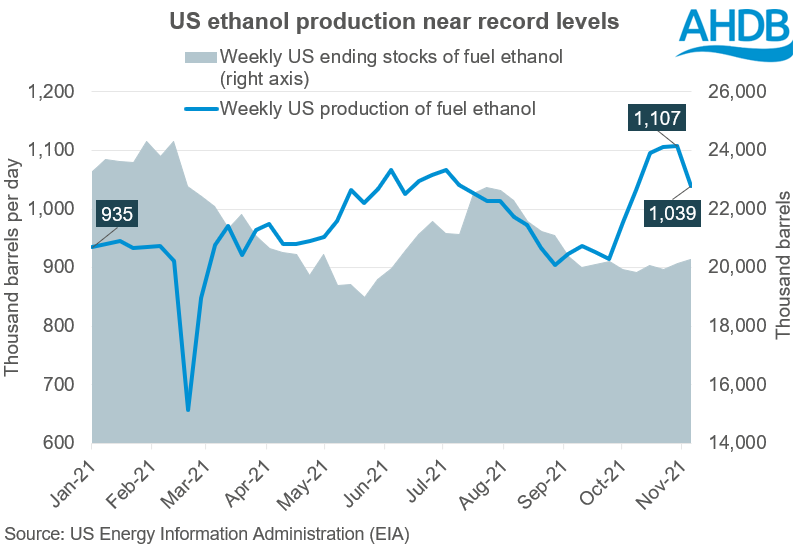

Weekly US ethanol production has been reaching near record levels. In the week ending 29 October, 1,107K barrels per day were produced. This sits only marginally behind the record of 1,108K barrels per day in December 2017. Though we did see a small dip in production in the most recent week to 5 November.

What has been driving this? Well, brent crude oil values have been finding strength, as well as CO2 prices rising, an output of ethanol production. This has been positive for ethanol margins, despite rising energy costs.

In turn, this has supported US maize prices. From 1 to 29 October, Chicago maize futures (Dec-21) increased $26.75/t. Though other factors including US planting intentions may be playing into price gains for US maize, strong ethanol demand has been a supporting factor.

Might this support continue?

Yes. In Tuesday’s USDA World Agricultural Supply and Demand Estimates (WASDE), US maize used for ethanol for the 2021/22 season was increased by 1.27Mt to 133.35Mt. This indicates recent strong ethanol production is anticipated to continue somewhat, resulting in higher maize demand.

Positive margins are expected to remain into next year for ethanol production. Crude oil prices may adjust and come down from the post-pandemic demand recovery. Though a cold winter is expected, and with high energy demand, we could see elevated prices into the first quarter of 2022.

For ethanol specifically, there are ongoing concerns around reduced retroactive blending mandates for US oil refiners for 2020 and 2021. Though, recently a group of US governors have requested the Environmental Protection Agency (EPA) move guidance on sales of E15 to all-year-round which may boost demand further if realised. Longer term, the US is working towards sustainable aviation fuel which could also boost ethanol demand.

UK focus

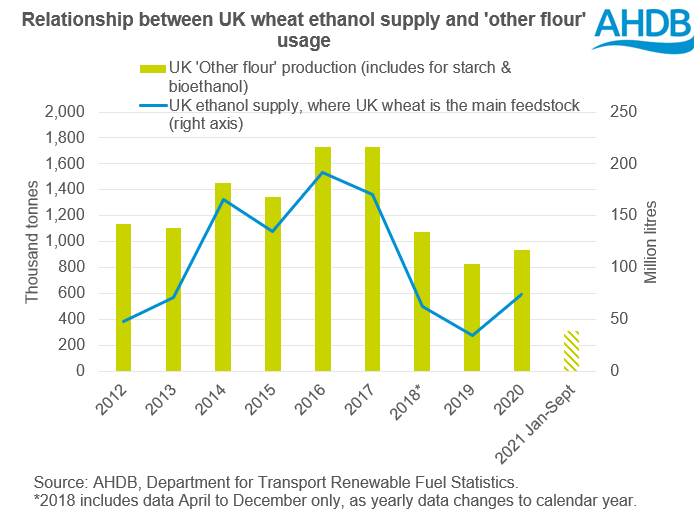

The move to higher ethanol demand is not just a global one. In September, the UK moved from E5 to E10 at petrol pumps. As part of the government’s plan to reach net zero emissions by 2050, this petrol is a blend of up to 10% renewable ethanol.

As a result, bioethanol plant Vivergo announced their return to production, due to restart in early 2022.

With increased ethanol demand, other flour production may be expected to increase, as seen in previous years.

Currently, season-to-date ‘other flour’ produced in the UK is only 1 percentage point (pp) higher year-on-year (Jul to Sept) from last season. However, with data only to September, we could see larger increases as we develop through the season.

With increased demand anticipated, we expect UK wheat supply and demand to be relatively tight for the 2021/22 season.

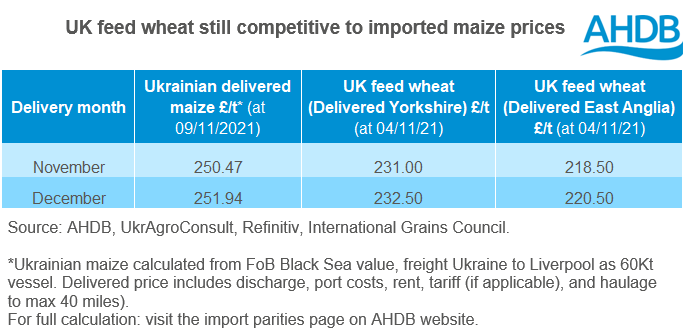

This said, margins will be key when determining feedstock used for ethanol. Primary grain feedstocks include low grade wheat and maize. Currently domestic feed wheat prices are competitive against imported maize. Should this remain, we could see strong demand for UK feed wheat through the season. Though if this changes, we could see a shift to maize.

Logistics and labour shortages are also factors to note when reviewing feedstock use. If logistic issues play into availability of UK feed wheat into the North East, it could mean feedstock options are narrowed.

To follow price competitiveness to maize, be sure to monitor delivered prices and UK import parities.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.