2021, a more subdued summer

Friday, 12 November 2021

Throughout summer 2021, Covid-19 restrictions were eased whilst foodservice re-opened at a reduced capacity. With a later than usual start to the hot summer weather, combined with greater option to eat out, the number of barbecues during 2021 declined versus 2020, but did this affect the sales of red meat and dairy?

We barbequed less this year, but spent more per occasion

With Covid-19 restrictions eased throughout summer 2021, and foodservice open at reduced capacity, the number of BBQs declined by 26% when compared to summer 2020, to 80 million occasions (Kantar, 16 w/e 8 Aug 2021). That’s the equivalent of 29 million less BBQ occasions than summer 2020. However, when we compare back to the summer of 2019, representing a more normal year, BBQ occasions have been sustained.

As the warm weather arrived later this year (between June and August), BBQs peaked in June 2021, where we saw 24.8 million occasions (Kantar, rolling 4 w/e 8 Aug 2021). The trend slowed through July as restrictions were lifted, but we saw a secondary peak in BBQ occasions in August 2021.

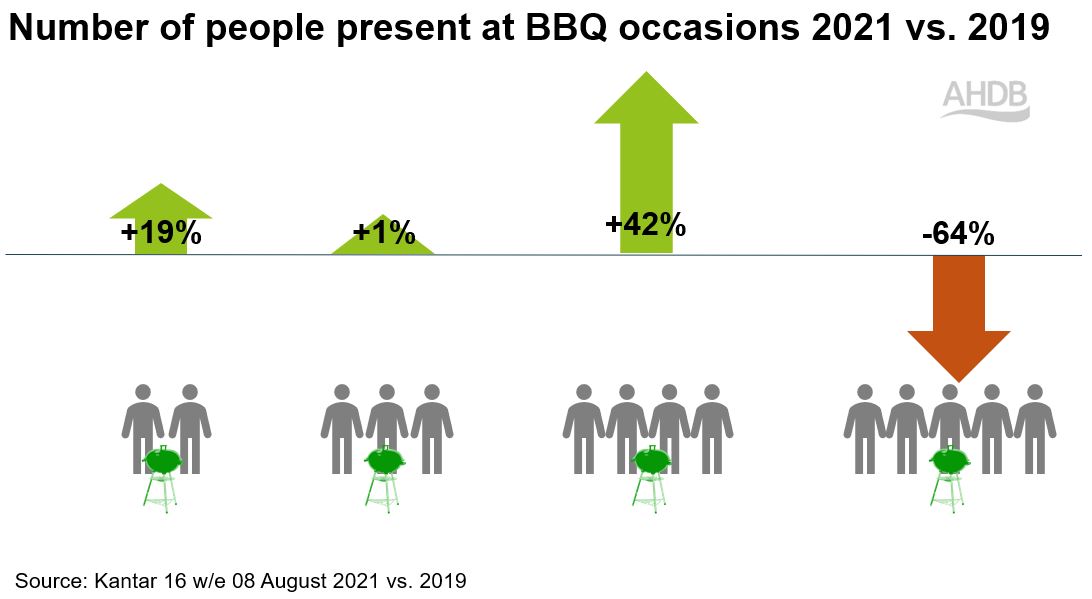

When comparing back to 2019, BBQ occasions throughout summer 2021 featured fewer people, so the smaller BBQ occasion increased, whereas BBQs featuring 5+ people declined by 64% (Kantar, 16 w/e 8 Aug 2021). This suggests some people are still reluctant to meet in larger groups and those who are meeting in larger groups returned to dining out in foodservice.

Although there were fewer BBQ occasions throughout 2021, the value of the BBQ occasion has increased 17%, driven by accompaniments, to reach £5.03 per occasion, up from £4.30 in 2019 (Kantar, 16 w/e 8 Aug 2021).

MFP performance

From a total retail perspective, not necessarily at BBQ occasions, total Meat, Fish and Poultry (MFP) consumed throughout summer 2021 declined on the exceptional year of 2020 by 4.6%, but when comparing back to summer 2019, grew by 4.8% in terms of volume (Kantar, 20 w/e 5 Sept 2021).

All MFP categories saw volume decline in summer 2021 versus summer 2020, with chicken and fish seeing the smallest declines. However, when compared back to the summer of 2019, fish (+6.7%), pork (+6.4%), chicken (+4.8), beef (+2.9%), and lamb (+0.8%) experienced volume growth (Kantar, 20 w/e 5 Sept 2021).

Burgers

Beef burgers featured at 157 million occasions throughout summer 2021, which is 14% more occasions when compared back to 2019 (Kantar 16 w/e 8 Aug 2021). Burger sales have been driven by both standard and premium label products with volume growth of +20.6% and 13.5% since 2019, in comparison to total burgers which experienced growth of 11.6% (Kantar, 20 w/e 5 Sept 2021). The consumption of burgers is primarily driven by consumers ‘wanting a treat’, but taste and practicality are also key in driving consumption (Kantar, 16 w/e 8 Aug 2021).

Sausages

Total pork consumed throughout summer 2021 was down 5.3% on summer 2020, but +6.4% when comparing back to summer 2019 (Kantar, 20 w/e 5 Sept 2021). The volume of pork sausages consumed throughout summer 2021 declined 11.8% versus summer 2020 but increased by 6.8% when compared to 2019 (Kantar, 20 w/e 5 Sept 2021).

Added value

Marinades saw volume growth of 7% over the summer compared to 2020, and +24% when compared to summer 2019. Beef and pork marinades did particularly well at +26% and +2% respectively compared to summer 2020, whilst uptake of lamb marinades, a smaller category, saw decline of 18% (Kantar, 20 w/e 5 Sept 2021).

Dairy

At a total level, cheese occasions throughout summer 2021 grew by 12% (an additional 221 million occasions) when compared to summer 2019 (Kantar, 16 w/e 8 Aug 2021). The volume of cheese sold was driven by ‘summer cheeses’ which saw significant growth when compared to summer 2019, with Halloumi (+21%), cheese slices (+15%), and Feta/Salad (+10%) respectively (Kantar, 20 w/e 05 Sept 2021).

In addition, cream occasions throughout summer 2021 increased by 10% when compared to 2019, to reach 201 million occasions (Kantar, 16 w/e 8 Aug 2021).

Key opportunities for 2022:

- MFP volume is driven in the first four weeks of Summer; therefore, it is vital to ensure BBQ products are available on shelf at the right time

- With unpredictable weather, ensure BBQ products are readily available at convenience stores throughout the summer period

- Practicality, enjoyment and health are key need states for beef, pork, and lamb, therefore ensure retail range and offering meet the needs of the consumer

Related content

2020: A BBQ summer like no other

Topics:

Sectors:

.JPG)