Shipping markets navigated

Thursday, 7 October 2021

By Rebecca Wright

Over the past few months global shipping prices have been mentioned in several AHDB pieces of analysis as having an influence on global markets but what is happening?

There are many ways to ship product round the world – air, sea and land. Air is the quickest for long distance freight transportation but is pricey. The reduction in passenger air travel during the Covid-19 pandemic has reduced air freight capacity. Sea freight takes longer but is cheaper. The overwhelming majority of global trade is transported by sea.

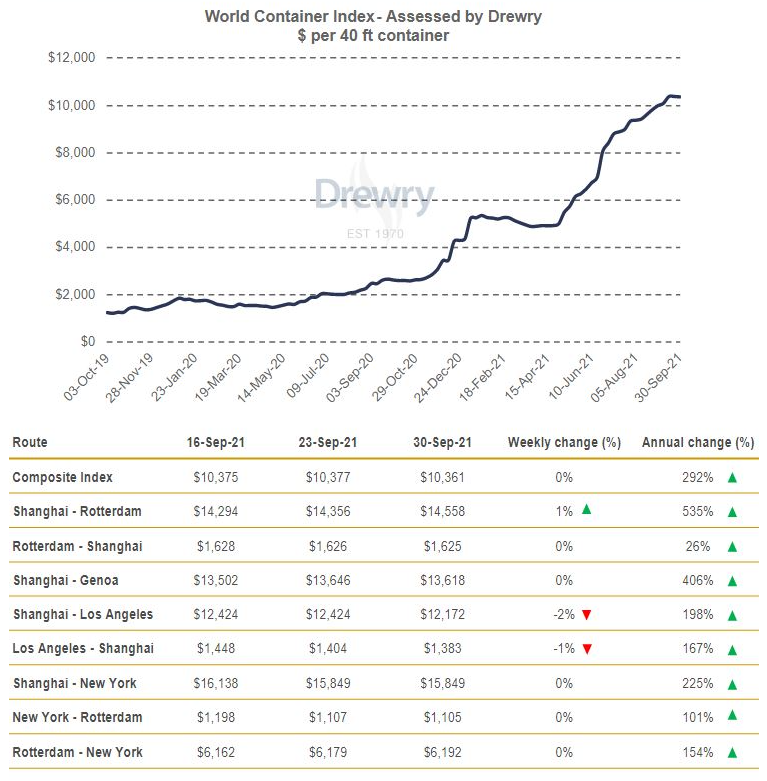

Global shipping costs have increased sharply since the Covid-19 pandemic began. The Drewry World Container Index currently stands at over US$10,000 per 40ft container, over 290% higher than this time last year. This is a composite index measure containing prices from various common freight routes.

Reefer (refrigerated) containers usually have a slight premium on them compared to dry containers. At the moment prices for dry containerized freight are around three times higher than reefer containers, but varies depending on the freight route. Into 2022, reefer freight rate growth is expected to outstrip that of dry containers.

What is driving up freight rates?

In a word – Coronavirus.

Some containers are at the wrong ports. This was one of the first issues which arose after the initial shock of some Chinese ports being closed during the early months of Covid-19. This continues to some extent.

Demand has increased. Last year with disruptions to shipping times coupled with rising freight prices some business chose to run down stocks. These stocks are now quite empty and therefore business now need to move products around. So, not only do we have this demand on top of normal stock turnover, but businesses are also looking to increase stocks as a risk mitigation measure.

Varying quarantining, isolating and social distancing policies around the world are having an impact on local work forces. Just recently an entire Chinese port terminal was closed for two weeks due to one worker testing positive for the virus. Social distancing is also slowing down the unloading and loading of vessels, increasing the time spent in port. Ports have become choke points with vessels queuing up waiting to enter.

As a mitigation measure, some vessels are longer stop at smaller ports in Greece and Eastern Europe to reduce delays.

This all adds up to an effective reduction in shipping capacity. Although the number of vessels may be similar, everything is taking longer than it did in 2019. This is affecting dry and reefer containers as well as bulk freight.

Reports suggest there is little sign of when things will improve. The largest commitment any expert is giving now is “sometime in 2022”. Reports released this week have begun to put the date for high spot shipping prices to reduce as far away as 2023, with contract prices also now being affected. A slowdown in economic activity in China caused by high energy prices might reduce container demand.

Subscribe to our Dairy Market Weekly newsletter and receive market updates in your inbox every Thursday

Subscribe to our Cattle and Sheep Weekly newsletter and receive market updates in your inbox every Friday

Subscribe to our Pork Weekly newsletter and receive market updates in your inbox every Friday

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: