Good fortunes continue for Brazilian pig meat exports

Tuesday, 2 November 2021

By Bethan Wilkins

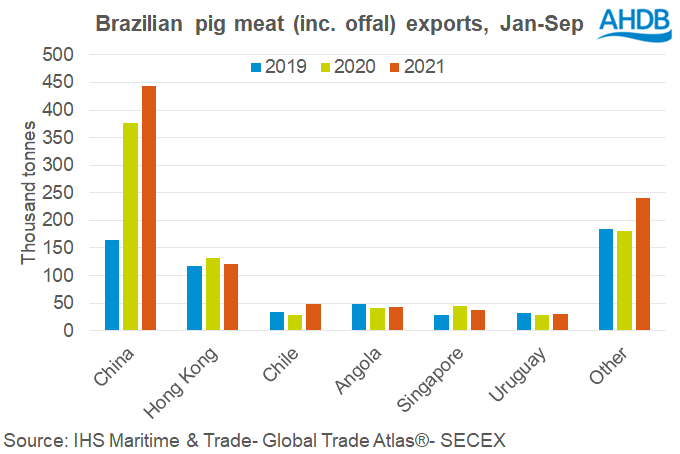

Overall, Brazilian pig meat exports (including offal) during the first three quarters of 2021 were 15% higher than in the same period of 2020, totalling 962,000 tonnes.

However, this represents a slowdown compared to the first half of the year, when shipments were up by 19%. The level of growth recorded in the third quarter was only +10%. The slower pace of growth has largely been due to stagnating exports to China, which has become Brazil’s largest market in recent years. China’s import demand has fallen overall in recent months, with increased domestic supplies weakening prices. Brazilian shipments to China in the first half of 2021 were 28% higher than during the equivalent period in 2020. By the third quarter, exports remained on par with a year earlier, although this was still more than double the level in 2019.

With opportunities for expansion on the Chinese market fading in Q3, several other markets have been important for the ongoing growth in Brazilian export volumes. Notable among them was the Philippines, which has taken more than three times as much Brazilian pig meat than during the same period last year. Almost 20,000 tonnes have been shipped there so far in 2021, taking it into the top 10 export destinations for the first time.

Chile has also been an important growth market this year, particularly in the first half when volumes were almost double 2020 levels, although the growth rate has slowed somewhat since then. Other smaller, but notable growth markets include Venezuela and Argentina.

The widespread success of Brazilian exports this year has no-doubt been aided by the devaluation of the Brazilian Real. The total value of exports for the year to September was BR11.6bn, a 30% increase compared to the year before. However, the increase is smaller in both US dollars (+24%) and Euros (+17%). The strong relative price-competitiveness of Brazilian exports represents a challenge for other global exporters, including the UK, as we compete for buyers on the global pork market.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.