China drives Brazilian beef export growth...but for how long?

Friday, 5 November 2021

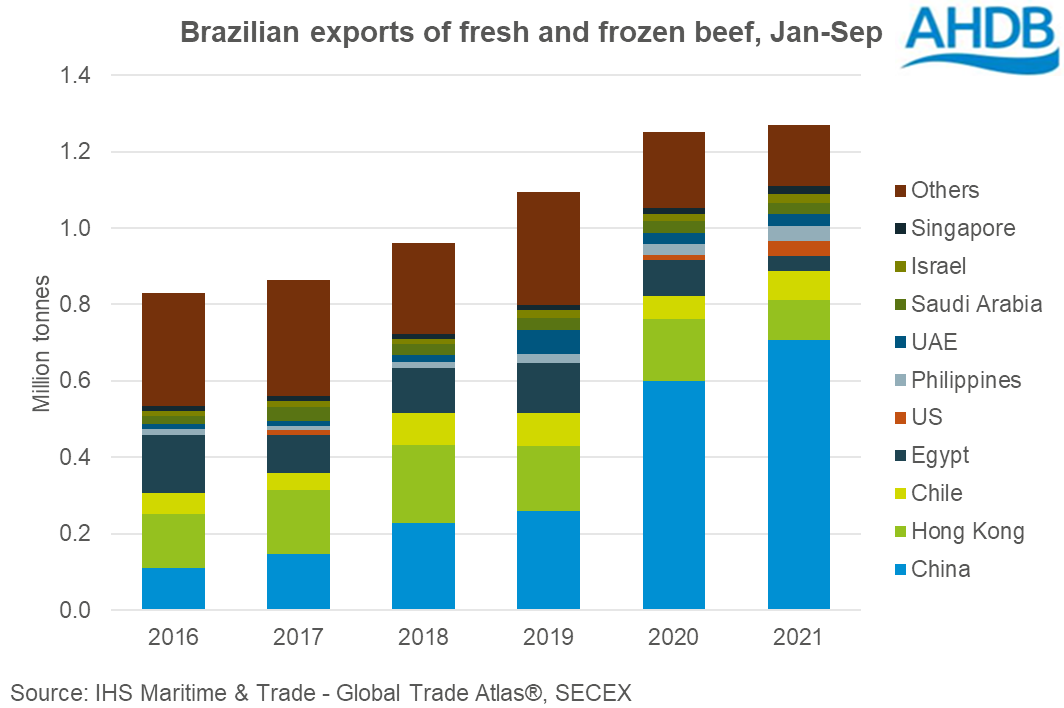

In the year to the end of September, Brazil exported 1.27 million tonnes of fresh and frozen beef, 1.5% more than was shipped during the same period a year ago.

Chinese demand has been the main cause of higher volumes, despite a ban being placed on Brazilian beef in early September. In fact, shipments to China during September were the highest monthly total on record at 112,000 tonnes (+31% year-on-year). Reports suggest this uplift could be to do with more containers being available compared to previous months.

Interestingly, according to Reuters, some Brazilian exporters had continued to load beef onto ships bound for China during the embargo, in the hope that the ban would be over by the time the ships arrived. However, the embargo remains in place (at time of writing), and shipments destined for China have reportedly been refused on arrival, which could mean they are redirected elsewhere, potentially to Iran and Vietnam.

Brazil is the largest exporter of beef worldwide, and China is its biggest market. It is still unknown when the ban will be rescinded, but continued blockages could see more beef staying on Brazil’s domestic market or finding a home elsewhere. For the UK market, it is unlikely that there will be any major impact, due to the more local nature of beef trade. Most beef imported to the UK from Brazil is as tinned corned beef.

Because of the time it takes to ship from Brazil to China, the effects of the embargo may not be reflected in trade data until the release of October figures at the earliest. We will monitor closely as this data becomes available.

Elsewhere, Uruguay and Paraguay also shipped more beef in the year to September, with volumes up by over 30% year-on-year. For Uruguay, China was the main cause of uplift. For Paraguay, increases went largely to Chile.

Argentina on the other hand exported less beef in the year to September, sending 429,000 tonnes (-2% year-on-year). Shipments were running above year-ago levels until June, after a cap was placed on exports in May. Exports to China were allowed to resume in late September, which may mean volumes increase in the months ahead.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.