Maize, a floor to UK new-crop grain markets: Grain market daily

Friday, 1 April 2022

Market commentary

- Yesterday, UK feed wheat futures (May-22) gained £2.00/t, closing the day at £307.50/t. New-crop (Nov-22) also gained (£2.65/t) to close yesterday at £261.65/t.

- UK feed wheat generally followed Paris wheat and Chicago maize market moves.

- The May-22 Paris rapeseed futures contract dropped €21.00/t yesterday, closing at €941.00/t. This follows Chicago soyabeans down, somewhat driven by a bearish USDA stocks report.

- Also, in oils, brent crude oil (nearby) dropped $5.54/bbl yesterday closing at $107.91/bbl.

- The second AHDB crop development report is now out. This gives an overview of major GB cereal and oilseeds crop conditions at the end of March 2022.

Maize, a floor to UK new-crop grain markets

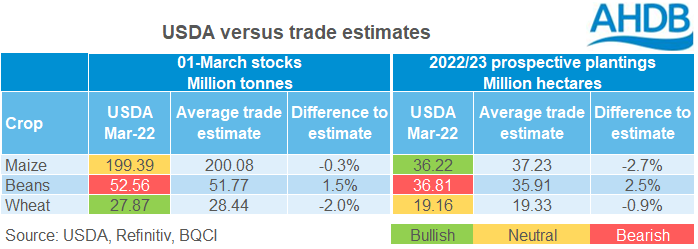

Yesterday, the USDA released two awaited pieces of data. These were the quarterly stocks report and the prospective plantings data for 2022/23. Some of the results differed from trade expectation, but there weren’t any major shocks. As expected, maize lost out to soyabeans for area, although to a greater extent than many foresaw.

Yesterday, Megan explained why US maize data matters. She explained how global maize availability is being squeezed, but now we have a better vision for harvest-22.

2022/23 maize availability prospects

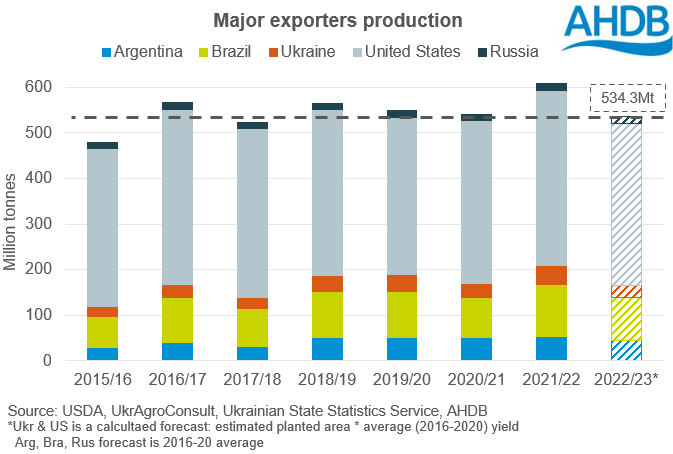

We have talked extensively in recent weeks about Ukrainian supply of maize to the global market. UkrAgroConsult recently revised its predicted cropping areas for harvest 2022. The anticipated maize area was 3.95Mha, down from 5.46Mha in 2021. The assumptions were caveated though, by an expected withdrawal of the Russian army within 4 weeks (now less than 3 as the report was dated 21-Mar), and therefore some may say it was optimistic. This said, there are reports that spring sowing is ahead of the same time last year, although it is unclear as to what crops are being prioritised in this campaign.

Nevertheless, this revised area estimate by UkrAgroConsult gives a base for production forecasts. Coupled with the latest US data we can look at two of the top four maize exporters.

US and Ukraine

Between the US and Ukraine, they account for c.48% of global maize exports (2016/17-2020/21). Using the area forecasts and average yields, we can now estimate production.

Applying a five-year average yield of 6.7t/ha (2017-2021), we could assume a 2022 Ukrainian maize production of 26.6Mt. This is 36% lower than harvest-21. Also, if the five-year low yield was achieved production would be c.5.0Mt lower still, at 21.6Mt (down 49% year-on-year). Not only is the Ukrainian maize area under question, but issues with input availability is adding uncertainty to yield potentials.

In the US, harvest-22 maize production could reach 355.5Mt based on a five-year average yield (2017-2021), back 7% year-on-year. Similarly, if only the five-year low yield were to be achieved, a significant reduction would be seen. In the US there are continued dryness concerns, Monday’s (04-Apr) USDA crop progress report may shed more light on this.

With these two key global suppliers looking to be back on production there is likely to be a continued tightness in global supply in 2022/23.

What does this mean for the UK?

A further tightening to global supply of maize is likely to support new-crop (2022/23) maize prices. The UK imports maize for use by both the animal feed and bioethanol industries. Both of which can switch to other feed grains if maize is priced “too high”. Ukraine is the UK’s top import origin for maize (2016/17-2020/21 average) but from 1 June 2022 the UK has agreed to lift the tariff on US maize imports.

Maize will provide a floor for the wider feed grains complex and if global prices are supported, will likely provide support for wheat and barley too.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.