Where now for wheat prices? Grain market daily

Wednesday, 22 February 2023

Market commentary

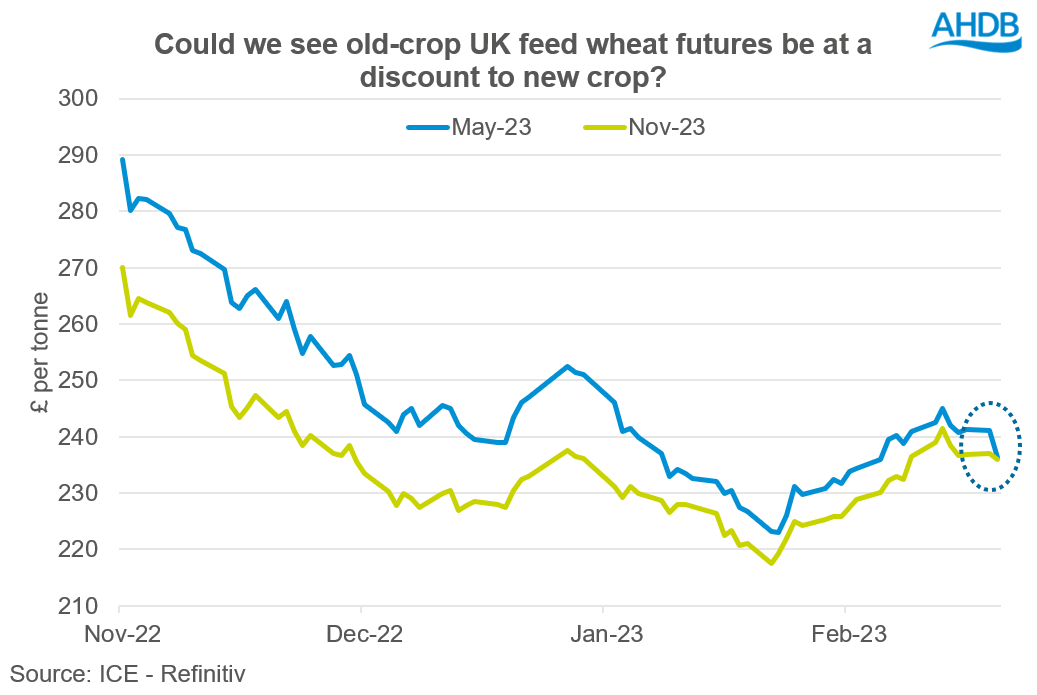

- UK feed wheat futures (May-23) closed at £236.25/t yesterday, down £4.85/t from Monday’s close. The Nov-23 contract closed at £236.00/t, down £1.10/t over the same period. Domestic prices followed the global market down yesterday. The US market was down due to strength in the US dollar and export competition, while the Paris market was down due to chart-based selling and export competition.

- A winter storm is set to hit the US this week, with heavy snowfall across the northern Plains and Midwest, but precipitation is expected to miss the drought hit areas further south of the Plains – a key watchpoint for US winter wheat conditions.

- Paris rapeseed futures (May-23) followed the wider oilseed complex up yesterday, closing at €560.75/t, up €3.25/t. The oilseed market is still focused on that on-going drought in Argentina.

Where now for wheat prices?

UK feed wheat futures (May-23) have been feeling an element of support since the end of January. The contract reached £245.00/t on the 14 February and since then it has been pressured. The May-23 contract closed down £4.85/t yesterday, while the Nov-23 contract closed down £1.10/t, meaning old crop is now only at a 25p premium to new crop.

Despite the recent support from escalations due to the war in Ukraine, as well as whether the Black Sea export corridor will continue, wheat prices are still on a downward trend. What happens next to the direction of wheat prices will largely depend on the renewal of this corridor, and up until this point a degree of volatility is anticipated.

The trade is still continuing to gauge the prospects of the continuation of this corridor, especially with an escalation in the conflict in the east of Ukraine. Further to that, President Putin has recently issued new nuclear warnings to the West, by suspending a landmark nuclear arms control treaty.

However, it’s been reported by the Ukrainian Deputy Infrastructure Minister last week, that negotiations are expected to continue in this coming week, anticipating that common sense should prevail, and the corridor will be extended.

What could happen?

Obviously, as history has shown us this can all change, but if the corridor is extended, the downward pressure on grain prices will likely continue, in the absence of any other bullish factors. Furthermore, there is still a large amount of wheat to be exported from Russia, which will likely continue to weigh on the grains complex.

From a UK perspective, if the corridor is extended, it is likely that both old and new crop prices will be pressured. However, if old crop prices come down at a greater rate, we could possibly see old crop futures move to be at a discount to new crop futures. This price relationship could incentivise some to carry stock over. However, the UK has a large domestic surplus of grain this season, wheat in particular, and as we approach harvest 2023, stores will need clearing to make way for new crop. Furthermore, old crop grain will need to be shifted to prevent carrying in a large volume of stock into next season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.