GB animal feed production at 6-year low from July to November: Grain market daily

Thursday, 12 January 2023

Market commentary

- May-23 UK feed wheat futures climbed £1.10/t from Tuesday’s close, settling at £234.10/t yesterday. New crop futures (Nov-23) closed at £228.00/t, gaining £1.50/t over the same period.

- European wheat markets were up on hopes of improvements in the economy, as well as being supported by upward movements in US prices. Chicago wheat futures closed up yesterday on the back of technical trading and markets aligning ahead of today’s trio of USDA reports.

- Paris rapeseed futures (May-23) closed at €571.50/t yesterday, gaining €3.25/t from Tuesday’s close.

- Rapeseed markets tracked soyabean markets up yesterday. As well as traders aligning ahead today’s USDA reports, support for soyabeans also came following Rosario Grains Exchange cutting its Argentinian soyabean production estimate by 12Mt to 37Mt.

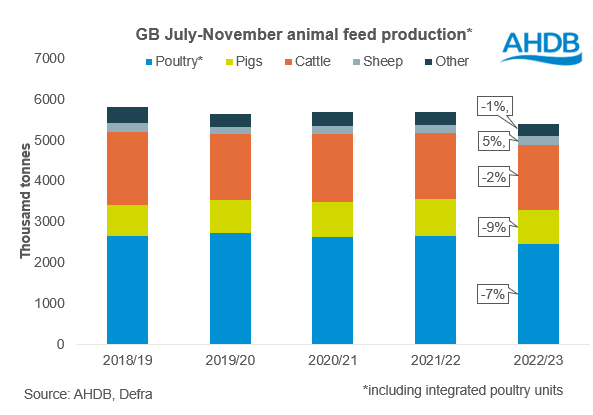

GB animal feed production at 6-year low from July to November

This morning, AHDB published the latest GB animal feed production figures, which includes information on cereal usage and animal feed production up to November. From July to November 2022, total GB animal feed production (including integrated poultry units (IPU)) was down 5% on year earlier levels, at 5.41Mt. This is the lowest level of feed production for the first five months of the season since 2016/17. While all major animal feed categories are lower on the year so far (except sheep feed), the main driver of the decline, unsurprisingly is the monogastric sector.

Compared to July – November 2021, total poultry feed production (including IPUs) was down 184Kt (-7%) at 2.48Mt. Both layer and broiler feed production has reduced by c.50Kt respectively over the same period. As has been well reported, both layer and broiler producers have been under pressure from squeezed margins, the avian flu outbreak and the cost of living crisis impacting consumer buying habits.

At 814Kt, total pig feed production was down 9% on the year, from July to November, driven by drops in both finisher (-33Kt) and breeder feed (-22Kt) production. The fall in pig feed production comes as the backlog of pigs on farm, caused by COVID-19 disruptions and labour shortages at abattoirs last year, is now thought to be relatively cleared.

For ruminants, total cattle and calf feed production is down 2% on the year so far (Jul-Nov), with a rise in dairy feed production, being outweighed by a drop in all other cattle feed. Sheep feed is the only sector which has increased on year earlier levels, with total production 10Kt higher year on year from July to November.

What does this mean?

With a reduction in animal feed production comes a fall in cereal usage. From July to November, wheat usage in total animal feed production dropped by 3%, while barley usage is down by 27% year on year.

It is expected that animal feed production will continue to decline this season, largely driven by reductions in poultry and pig feed production. With high input costs expected to remain this season, producer margins are going to continue to be squeezed. On top of that, a shift in consumer buying habits is expected to continue, due to the cost of living crisis.

Despite a projected decline in animal feed production, in the November UK cereal supply and demand estimates, wheat usage in animal feed (including fed on farm) was estimated to remain relatively unchanged on the year. This is because the proportion of wheat used in rations is expected to rise due to its availability and price compared with other cereals. On the other hand, barley usage was forecast to decline by 5%. If animal feed production declines more than initially anticipated, then we could see less cereal usage in animal feed, which could add to the already substantial exportable surplus of grains, if other areas remain unchanged.

Keep an eye out for the next UK cereal supply and demand estimates which are due to be published on 26 January.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

.png)