UK wheat exports hit near 40 month high in January: Grain market daily

Wednesday, 15 March 2023

Market commentary

- Old crop (May-23) UK feed wheat futures closed at £217.00/t yesterday, unchanged from Monday’s close. New crop (Nov-23) futures gained £0.50/t over the same period to close at £222.20/t. The slight support came from stronger global demand and the ongoing uncertainty around the Ukraine export corridor extension deal.

- May-23 Paris rapeseed futures closed at €482.75/t yesterday, down €2.50/t from Mondays close, with prices pressured by movements in the wider oil complex.

UK wheat exports hit near 40 month high in January

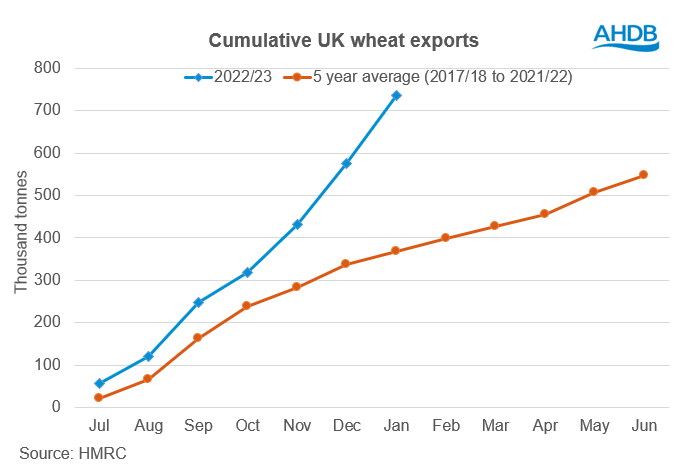

On Friday, HMRC released the latest trade data, which includes volumes exported and imported up to the end of January. With a substantial exportable surplus of domestic grains (especially wheat) this season, are exports on track to shift this large surplus to prevent large carry-out stocks?

So far this season (Jul-Jan), the UK has exported 735.8Kt of wheat, which is over 2.5 times the volume shipped by this point in 2021/22 and the largest volume exported for this period since 2019/20. The pace has been picking up over recent months, with 159.5Kt of wheat exported in January, the largest monthly volume shipped since October 2019.

In the January UK cereal supply and demand estimates, 2022/23 full season wheat exports were estimated at 1.150Mt. Taking into account what has been exported up to the end of January, that leaves around 414Kt of wheat to be exported from February to June to meet the forecast. This would average out at around 83Kt per month for the rest of the season, which judging by the pace to date and the availability the UK has, should be more than doable.

Another data source, which can help us assess UK trade is the data from the EU weekly cereal trade customs surveillance. According to latest data published by the EU Commission, the EU has imported 1.047Mt of common wheat from the UK up to 13 March.

Given the pace to date and considering the data from the EU Commission, it is likely we will actually see UK wheat exports come in higher than the current estimate. However, how much higher is unknown, and depends on several factors, including how competitive UK wheat is on the export market amongst others. Plus, with there now technically a price carry into new crop (where old crop values are lower than new crop), could this encourage growers to hold onto stock rather than sell? In reality though, carrying stock is very much dependent on individual cash flow and storage availability. In my opinion, I don’t believe the pace will remain as strong as we near the end of the season, but it is very likely we will see full season exports tip the 1.150Mt mark.

Looking at other grains and UK barley exports have reached 674.2Kt in the season to date (Jul-Jan), and oat exports total 117.6Kt over the same period. Currently full season barley and oat exports are estimated at 1.000Mt and 115Kt respectively. With the July to January pace, already exceeding the full season estimate for oats, that will need to be revised in the next balance sheet update. There may also be some room for movement in the barley export forecast given the strong pace to date.

The next UK cereal supply and demand estimates for 2022/23 are scheduled for publication on 30 March and will take into account the latest trade and usage data.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.