Arable Market Report - 20 March 2023

Monday, 20 March 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

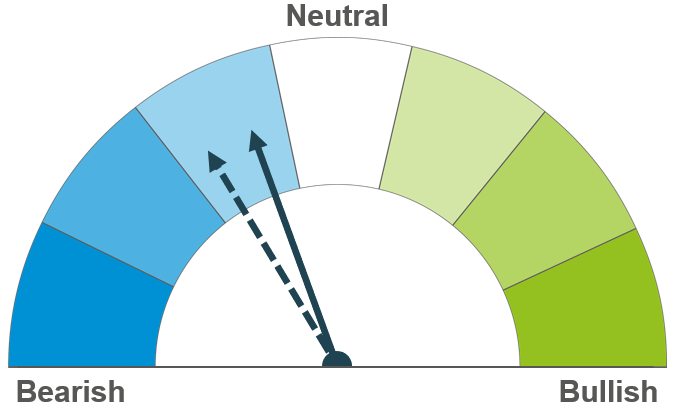

Wheat

Maize

Barley

With the Ukraine export corridor confirmed for another 60 days, some global supply concerns have been eased. Demand direction will be a key watchpoint as prices hit lower levels. However cheap, ample Russian supplies continue pick up demand and pressure the market short and long term.

Demand remains a key market mover, will China continue to purchase US maize? Argentinian crop concerns also remain a watchpoint. Though longer term, the US maize crop (new crop) is anticipated to be large.

Barley prices continue to follow the wider grains complex. Discount of ex-farm UK feed barley to UK feed wheat stood at £19.40/t as at 09 March.

Global grain markets

Global grain futures

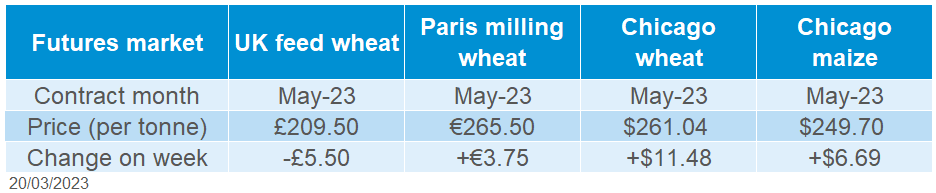

Global grain markets felt some support last week overall. US and European wheat markets (May-23) found strength from concerns on whether there would be an extension of the Black Sea Initiative (Ukraine export deal) which was due to expire on Saturday (18 Mar), and Chicago maize (May-23) found support from strong Chinese demand. As financial market concerns grow, the US dollar saw some weakening last week.

On Saturday, the Black Sea Initiative was renewed for at least 60 days, which markets had anticipated from news earlier in the week. This is half the time (120 days) that the deal has been previously renewed for, though it still steadied some concerns on global supply. This deal allows the safe export of Ukrainian grain, brokered by the UN and Turkey back in July 2022. Concerns grew last week as we moved closer to the end date of the previous extension. Though Russia have warned an extension beyond mid-May would depend on the removal of western sanctions, according to Refinitiv.

Today, the Russian Agriculture Ministry proposed a new scheme for Russia’s foreign trade with payments via the national clearing centre, for grain and other agricultural exports. This would protect Russia against any further tightening of sanctions (Refinitiv).

Strong demand too helped to support global grain prices last week. Wheat was purchased by Algeria (540Kt milling wheat), Tunisia (234Kt soft wheat) and Jordan (60Kt milling wheat) last week. For US maize, private exporters recorded 2.111Mt of flash sales of maize to China for delivery this marketing season last week (14/03 – 17/03).

New-crop conditions remain the key focus going forward. Reports of frost and cold conditions in the US over the weekend are something to monitor. Stratégie grains, in their latest report released last week, trimmed their outlook for EU production of soft wheat and exports for this season (2022/23) and next season (2023/24). New season soft wheat production is now pegged at 129.5Mt, down from 129.7Mt in February’s forecast, but higher than this season’s crop now pegged at 125.1Mt. The consultancy stated that despite rains in west Europe, levels had not been sufficient to fully remove long term drought risk in particularly France and Spain. For soft wheat exports, these are now pegged at 30.0Mt for this season (2022/23) and 30.3Mt for next season (2023/24), down 100Kt and 300Kt respectively from February’s forecast.

UK focus

Delivered cereals

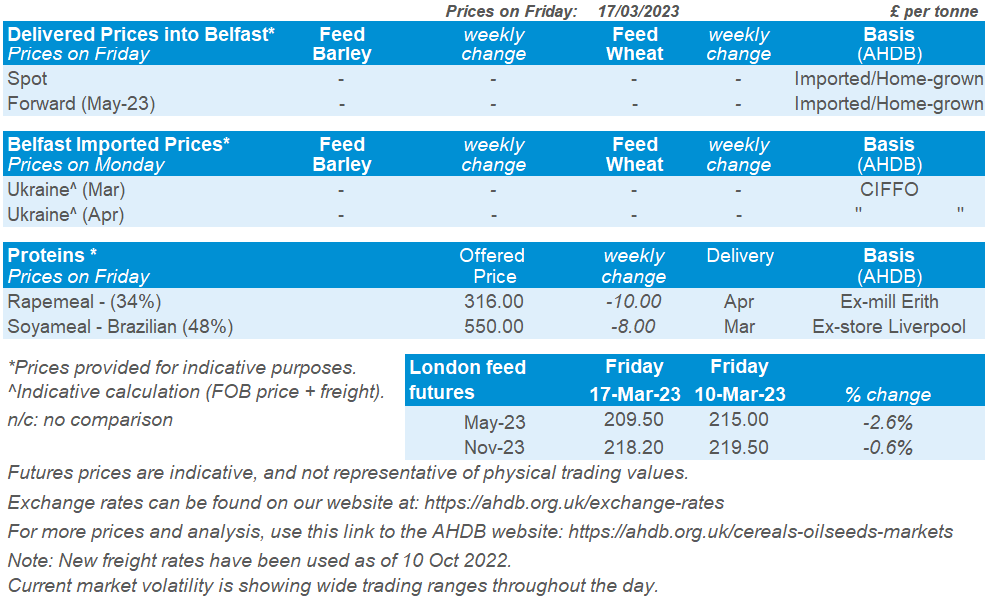

UK feed wheat futures saw pressure last week, despite US and European wheat markets seeing support. For old crop prices (May-23), futures fell £5.50/t last week, to close on Friday at £209.50/t. New-crop prices (Nov-23) fell only £1.30/t over this period, to close on Friday at £218.20/t.

The sterling found some support last week, closing higher against the euro (up 1.06%) and US dollar (up 1.22%).

Also, important to consider the UK has large wheat availability this season and has been seeing a strong wheat export pace. According to the latest UK HMRC trade data, UK wheat exports high a near 40 month high in January.

Delivered prices followed futures movements last week (Thursday to Thursday). Feed wheat delivered into East Anglia (March 23 delivery) was quoted on Thursday at £211.50/t, down £4.00/t from the previous week.

Into Avonrange, spot feed wheat (for March 23 delivery) was quoted at £213.50/t on Thursday. For the same destination, harvest 23 feed wheat was quoted at £215.50/t.

Bread prices delivered into the North West (March 23 delivery) were quoted at £288.50/t on Thursday, down £2.50/t from the previous week.

Oilseeds

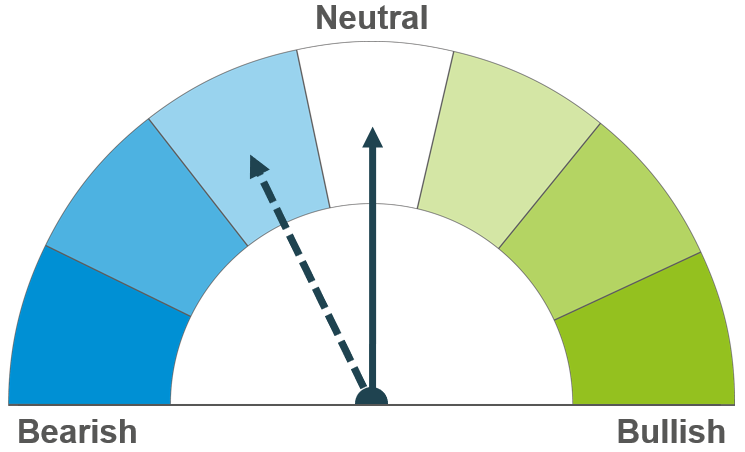

Rapeseed

Soyabeans

Pressure on crude oil from global financial worries is weighing on rapeseed prices in the short-term. This combined with ample European supplies means prices could drop further going forward.

The impacts of the Argentinian drought have been priced into the market. Longer-term a record Brazilian crop could continue weighing on these high prices.

Global oilseed markets

Global oilseed futures

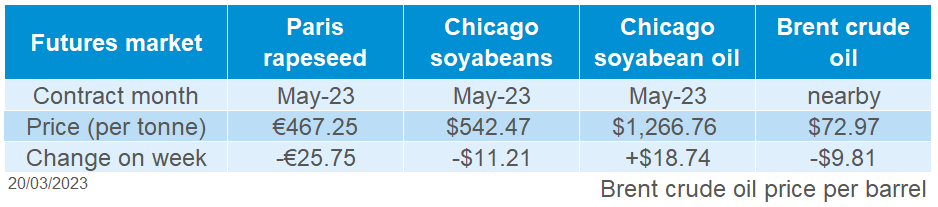

Pressure across the week on the oilseed complex as Chicago soyabean futures (May-23) were down 2%, closing Friday at $542.47/t, the lowest point so far this calendar year. The main cause of pressure this week has been fears over a global economic crisis and the Brazilian soyabean harvest which is weighing on Brazilian soyabean prices.

The collapse of Silicon Valley Bank rattled equities markets and trouble at Credit Suisse has sparked fears of a fresh financial crisis. With this anxiety, crude oil markets were pressured. Nearby brent crude oil closed at $72.97/barrel on Friday, down $9.81/barrel across the week.

On Thursday, Buenos Aires Grain Exchange further slashed Argentina’s soyabean crop, now estimated at 25Mt, the lowest since 1999/00 if realised. Much of the damage is now priced into the market. The Brazilian soyabean harvest is on-going with 63.1% complete as reported on Friday, down from 71.68% at the same point last year (Patria Agronegocios).

Brazil’s National Energy Policy Council (CNPE) on Friday raised the country’s mandatory blending on biodiesel to 12%, starting in April. This is proposed to gradually increase over the next few years, with levels rising to 15% by 2026.

Rapeseed focus

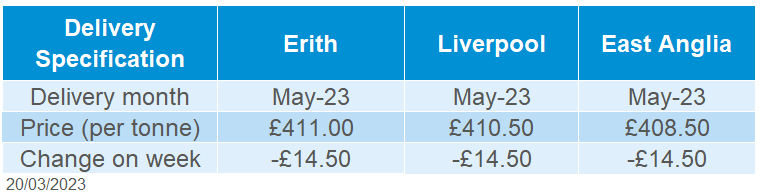

UK delivered oilseed prices

Pressure within the oilseed complex weighed greatly on rapeseed prices. Further to that, notably the weakness in rape oil is weighing on rapeseed prices too, as rape oil prices in Rotterdam (as at 16 Mar) were at a discount to crude palm oil, reiterating the bearish fundamental of rapeseed within Europe (Oilworld.Biz).

Paris rapeseed futures (May-23) closed Friday at €467.25/t, down €25.75/t across the week. Delivered rapeseed (into Erith, Mar-23) was quoted at £408.00/t on Friday, down £15.50/t across the week. There was greater weekly pressure on Paris rapeseed futures due to the market dropping further after the AHDB delivered survey was conducted on Friday mid-morning.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.